One would expect that the insurance sector, which is a crucial industry that provides a buffer and protection for people and businesses from unforeseen events, would be more proactive in adopting new technology but the reverse is actually true. While many companies in other industries are already embracing a cloud-first approach or a hybrid one, and leveraging artificial intelligence to their advantage, only a small fraction of insurance companies have the necessary tools, with a mere 15% equipped with APIs for efficiently using data.

One insurer that’s pushing for change and embracing new technology – and the challenges that come with it – is one of Brazil’s top insurers, Seguralta.

About Seguralta

With a rich legacy spanning 55 years, Seguralta is a distinguished company in the insurance sector. It is a franchise company with a large network that has more than 1,800 units and R$700 million (roughly AUD 210 million) in insurance, consortium and pension premiums, operating in three business models – home office, basic and standard.

The Business Challenge

Similar to many insurance companies in and out of Australia, Seguralta’s challenges in today’s business landscape are worsened by the slow speed of technology adoption within the industry:

- Scaling and Decentralisation: Seguralta encounters challenges in scaling its operations efficiently due to outdated systems and a decentralised network of franchise units, resulting in data silos. Coordinating processes and standardising operations across the network presents difficulties, hindering scalability.

- Compliance: When it comes to adopting technology, compliance and security concerns further complicate matters, often resulting in delays and less effective implementations, potentially inviting penalties from regulatory bodies like SUSEP (Superintendência de Seguros Privados) the Brazilian equivalent of Australian Prudential Regulatory Authority (APRA).

- Diminished Customer Service: Technological limitations can lead to delays in processing and lack of automation, impacting customer service quality. These delays in follow-up may result in decreased customer satisfaction and retention.

- Potential Loss in Sales: The inefficiencies in processing and automation may lead to missed sales opportunities for Seguralta. Without prompt processing and follow-up, potential policy sales could be lost, affecting revenue streams.

- Impact on Operational Efficiency: Outdated systems and processes can hamper Seguralta’s operational efficiency. Inefficiencies in data management and integration may result in slower decision-making and hinder the company’s ability to adapt to market changes swiftly.

The Solution: A Two-Pronged Strategy for Technological Transformation

In a bid to address the technological challenges, the collaboration with Seguralta focussed on two complementary fronts: the first is a modern data stack based on data contracts that manages 40 different insurers with five data ingestion methods (REST API, Webservice, Front-end RPA, CURL Requests, and Email Processing). The other front is the creation of a SuperApp, consisting of a single platform that is mobile-first, with operational details, business generation, and business intelligence, thus unifying seven other solutions currently available.

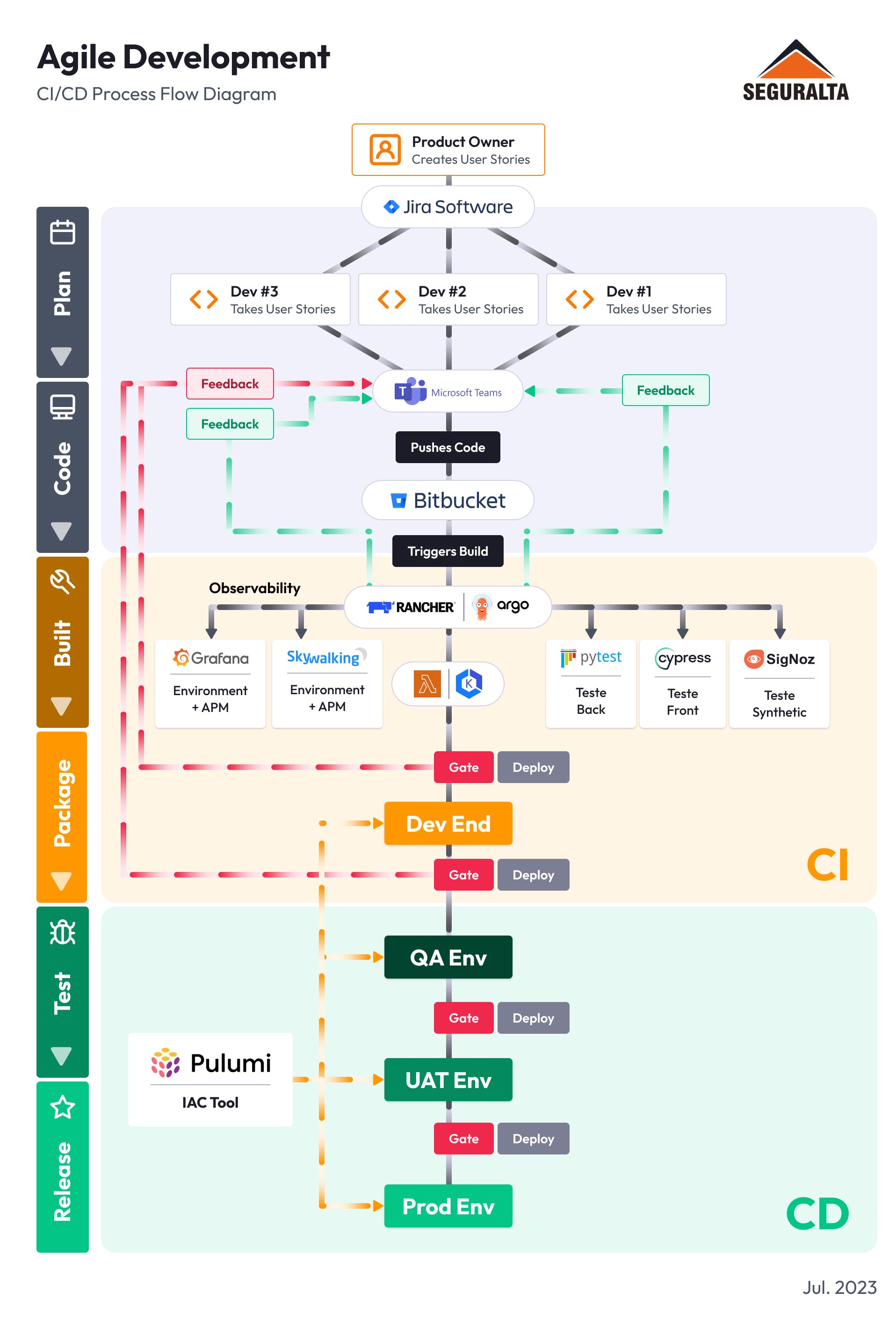

For Seguralta, in addition to innovation, both solutions must have security as a fundamental requirement, ensuring the presence of good practices and regulatory consistencies. They must also be capable of constant evolution, as many capabilities and features depend on the co-dependency with 40 external partners, requiring an agile DevOps and CI/CD culture for the development of new features to meet potential changes in partner scenarios.

Architecture: Creating the Seguralta SuperApp

To create the Seguralta SuperApp, the project was divided into three main fronts: data, backend, and frontend. The goal was to avoid any data processing within the backend and to use native AWS solutions, focusing on providing the best user experience.

To ensure the workflow’s functioning and solution integrity, Seguralta adopts Infrastructure as Code (IAC) throughout the entire platform, implementing the DevOps flow below:

Source: aws.amazon.com

Developing the Data Stack for a Single Source of Truth

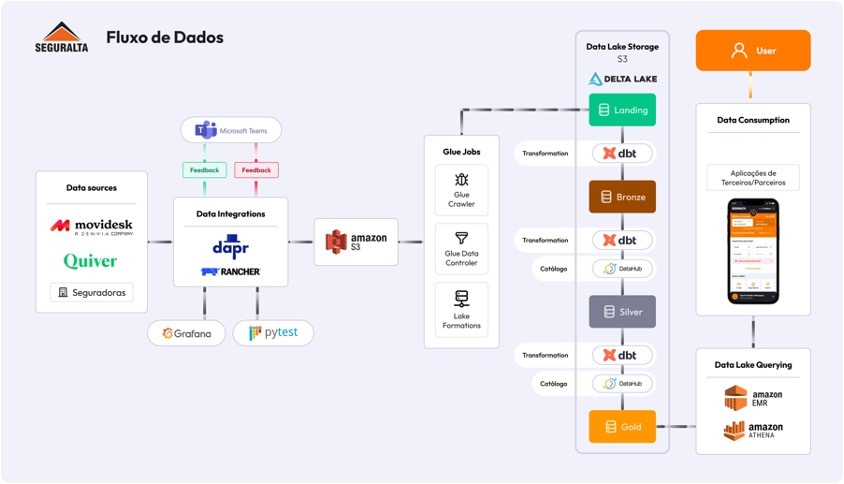

After implementing this defined flow, the focus switched to developing the Data Stack, covering the data ingestion, processing, and consumption processes by applications:

Source: aws.amazon.com

The Amazon Elastic Kubernetes Service (Amazon EKS) was used for ingestion of both 1st Party Data and operating system databases, as well as partner data sources. Five different ingestion categories were created, namely, API, CURL, Text Files, Frontend Crawler, and Email Crawler. After ingestion, DBT is used for data processing to the Silver layer, standardising and ensuring the integrity of data systems. In this phase, Datahub catalogues and controls all Data Contracts.

Following this process, business rules were applied and DataMarts were provided in the Gold layer that the SuperApp Core consumes. In all layers, Amazon Simple Storage Service (Amazon S3) is used directly and data is stored in Parquet, using Amazon EMR to abstract and return data to both the SuperApp Core and BI systems.

No backend layer is used between the SuperApp and data consumption, delegating this entire layer to Amazon EMR and AWS Athena, with integration via Amazon API Gateway, validating data contracts in DBT and Datahub. This ensures the consistency and accuracy of data exposed to customers directly from the Data Lake built on Amazon S3.

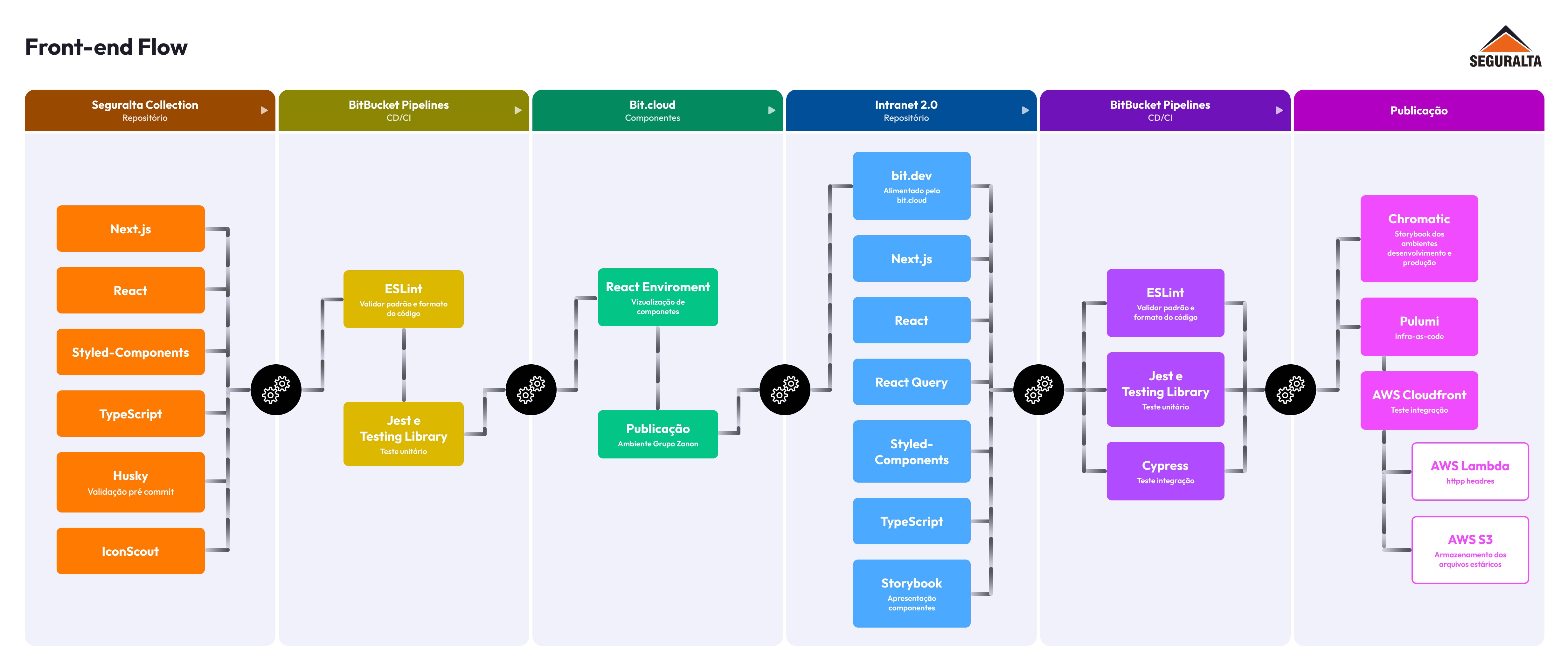

As the architecture depends directly on Frontend integration with the Data Stack, the focus is on a modern architecture, composed of three types of tests:

Source: aws.amazon.com

In line with product security, solutions such as Amazon Cognito integrated with Amazon API Gateway were also used to handle the entire authentication and login system, aiming to ensure that no sensitive data is exposed.

Notably, the adoption of a data lake proved instrumental in solving challenges and maintaining data accuracy. With the transition to native AWS technologies, Seguralta achieved enhanced data orchestration and real-time updates, ensuring that franchisees receive up-to-date information. This single source of truth facilitated by the data lake not only optimised performance and cost but also contributed to the overall modernisation of their operations. With this approach, the resilience of the architecture, operational efficiency, security, and value generated throughout the chain, are ensured from insurers to franchisees.

Conclusion: Increased Operational Efficiency and Scalability

With the launch of the SuperApp, Core, Seguralta plans to reduce operational call rates by up to 50% and reach 4,000 unique users using the platform per day, with an average of 4 hours of logged-in time, accelerating the use of data for enriching the end-user experience.

Seguralta plans to evolve the project over the next three years with the chosen architecture, maintaining costs, the same team, and ensuring scalability of up to 300% of the current usage. They also aim for an uptime of 99% in the environment. Therefore, the benefits range from optimised costs, environment operation, resilience, and performance, delivering a significant advantage and value to the business.

Article originally published on the AWS Blog