OPEN BANKING

Adatree CDR compliant Open Banking platform with DNX.One cloud foundation

Uncover benefits, remove barriers, and take advantage of the Consumer Data Right (CDR) data-sharing ecosystem through turnkey, secure, and cloud-native Data Recipient solutions.

HOW WE DO IT

What is the Consumer Data Right (CDR)?

The Consumer Data Right (aka Open Banking) is legislation giving Australian consumers greater access to their data, improving consumer choice and competition. Adatree’s SaaS technology solution removes the complexity of accessing the CDR safely and securely, enabling businesses to do this through one Open Banking API. DNX adds security, reliability, and cloud foundations to the solution.

How is Open Banking related to the Consumer Data Right?

CDR aims to empower consumers to share their data across different providers through secure channels. Consumer Data Right has first launched in the financial sector, which has given it the name ‘Open Banking’. In the future, CDR will enter other major industries including the energy sector, telecommunications, and retail.

Open Banking and the CDR in Australia.

Australia approved the CDR legislation in August 2019. This was a major step towards giving consumers control and autonomy over their data, with the ability to share data with secure third parties such as banks and mortgage brokers. The switch to Open Banking is ongoing, with the third and final phase due to be implemented in February 2022.

HOW WE WORK TOGETHER

Simplifying the CDR Open Banking, and cloud needs.

Adatree removes barriers to entry across the data-sharing ecosystem, enabling any organisation to access the CDR through a single CDR Open Banking API.

As an Accredited Data Recipient, Adatree does the heavy lifting to help you leverage data and be technically compliant, while you focus on creating competitive and innovative products and services to grow, retain, and delight your customers.

DNX Solutions is a cloud-native focused company equipped with solutions to tailor your CDR data environment.

From building a secure, compliant, and cloud conforming foundation, to injecting cloud and data skills into your organisation, DNX accelerates the process of being granted as an Accredited Data Recipient (ADR) while partnering with the audit team.

ABOUT THE SOLUTION

Enable your business to access and leverage the CDR

Adatree’s turnkey CDR Open Banking platform enables your business to access and leverage the CDR. DNX builds your secure, compliant, and cloud conforming cloud environment. With Adatree and DNX working together, you know your CDR Open Banking solution is compliant and secure so that you can focus on your customer value propositions.

Industry Sandbox

Adatree’s Open Banking Industry Sandbox is an out-of-the-box implementation of the Adatree Data Recipient Platform.

All of the technology, APIs, endpoints, and the platform create a real-life simulation of the end-to-end aspects of Open Banking.

Data Recipient Platform

One CDR Open Banking API for everything that you need technically when you are an Accredited Data Recipient. Adatree’s modular Open Banking platform provides all technical components necessary for Data Recipients to securely receive consumer data in an efficient, legislation-conformant way.

The Open Banking API solution is specifically built to the Australian CDR standard.

DNX.One Foundation

As the first layer of any data-focused solution, DNX.One Foundation was built to enable your cloud and data environment to be compliant with CDR and AWS Well-Architected best practices.

In addition, DNX.One builds a secure, high-available, low-cost, and scalable infrastructure with infrastructure-as-code and open source technologies.

SRE team & Managed Services

DNX provides a team extension while building your environment, empowering your team with cloud skills, and supporting your audit team to get things done quicker and easier.

A cloud-managed service capability is another option in case you don’t have one or if your existing SRE team needs assistance with scaling. We can transition operating the open banking platform while you grow.

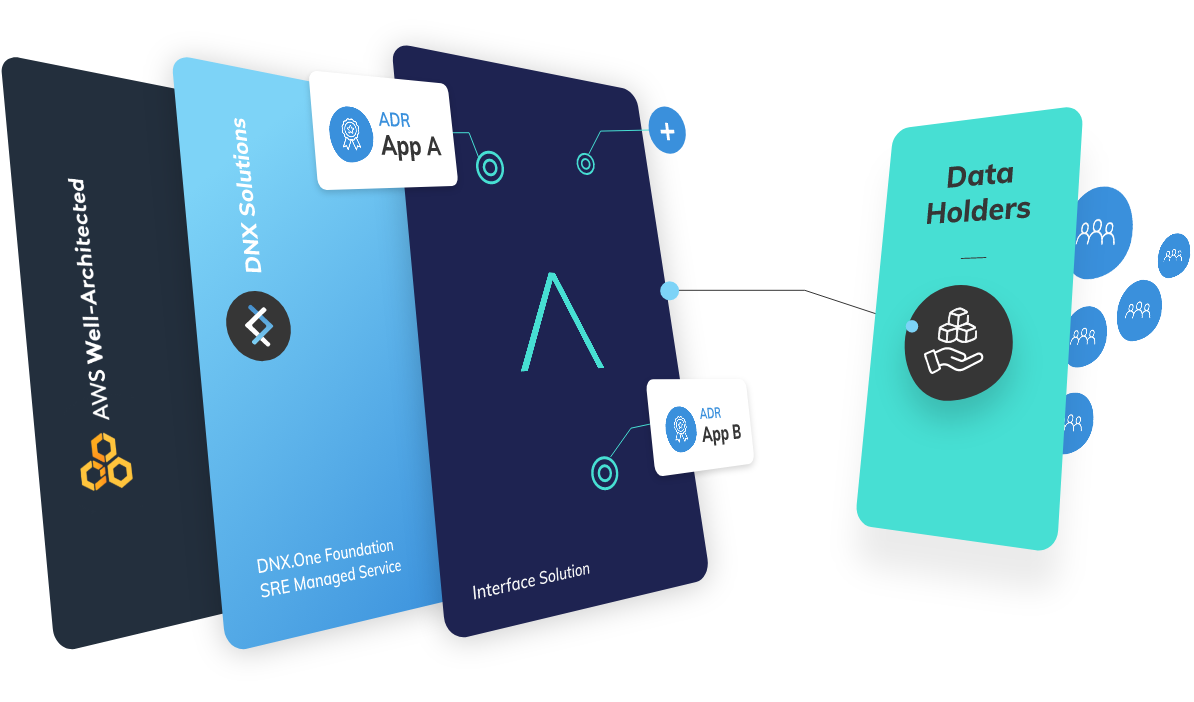

HOW IT WORKS

How the data flows

Adatree’s CDR SaaS solution provides organisations with access to the CDR through one Open Banking API, removing the complexity of adhering to building and maintenance standards. DNX provides the cloud foundation layer to enhance the ease and security of Adatree’s CDR platform while building all of your cloud infrastructure needs.

REASONS WHY

How you can use our

solutions over the CDR journey.

PREPARING

Start with Adatree’s Industry Sandbox before becoming accredited and stepping into CDR and Open Banking.

ADOPTING

Meet CDR compliance standards to start receiving data and guarantee a smooth migration process

EVOLVING

Evolve, manage, and take advantage of the CDR with a range of product and service add-ons from Adatree and DNX Solutions

TARGET

Who are the Adatree and DNX CDR Open Banking API for?

Discover how some industries can take

advantage of the CDR environment with these Open Banking cases

TESTIMONIALS

What customers

say about us

CLIENTS

Join smart organisations that have embraced the CDR and cloud environment!

CDR OPEN BANKING API BENEFITS

All of the CDR benefits

and none of the burden

Simple and fast access to the CDR

Access the CDR through a single API. Automated deployment enables same day access to our Industry Sandbox and Data Recipient Platform.

Adatree Turnkey solutions

Out-of-the-box technology solutions for Data Recipients. Everything an organisation needs to participate securely in the CDR, without building it themselves.

Secure and reliable “Ready To Go” infrastructure

A “Ready To Go” AWS cloud platform built to be compliant with CDR while providing a reliable and secure environment without adding complexity.

High scalability and availability

Harness a global and trustful AWS platform as your business grows and demand increases.

Developer Portal

With Adatree’s Industry Sandbox you can test your use cases in a CDR compliant environment before you are accredited.

All industries, all use cases

Adatree’s SaaS solution is industry and use case agnostic. We enable any organisation that would like to be part of the CDR

Optimised and cost-effective cloud environment

Leverage the most optimal and cost-efficient cloud services while reducing operation costs.

Flexible skills and continued CDR compliance mechanism

Find out the skill you need to evolve your cloud state and keep your Open Banking application continuously compliant.

Get your

Open Banking

use case report

GET STARTED

Want to find out more about our CDR open Banking offering and discuss your data state?

Fill out the form and our team will give you a call.

*DNX/Adatree funding is available. Let us assess your data state and suggest the best option based on your business needs.

BLOG

Explore our case studies

OUR SOLUTIONS

Explore other solutions

DNX Solutions

Well-Architected ReviewUncover how your cloud architecture adheres to the AWS Well-Architected standard.

Cloud FoundationEnable a scalable, compliant cloud as your business grows.

Application ModernisationLeverage the power of the cloud to fully realise value from modernisation.

Data Engineering & AnalyticsCloud and data engineering to support your data modernisation landscape.

Cloud Managed ServicesEvolve your SRE capability to efficiently operate the cloud.

Adatree

Data Recipient PlatformEverything you need technically to be an Accredited Data Recipient. Connect with one API.

Industry SandboxDeveloper environment with a Data Recipient platform to build of proof of concepts, in a simulated CDR environment.

CDR Data StorageLeverage our audited technical environment to store your CDR data

Data SandboxDiscover what you can get through Open Banking, data formats, and whether it meets your needs

Product Reference Data APIA quick and tactical Product Reference Data API solution for Data Holders

ADR AcceleratorAccess all of the business and technical templates you need for your ADR application and save weeks of your journey